Inventory Adjustment

Inventory adjustments are used to increase or decrease item quantities and cost basis in ianaiERP to reconcile differences between physical stock and system records. Such differences may stem from spoilage, theft, loss, or receiving errors. Use adjustments sparingly: first review the item’s transaction history, check for incorrect or missing transactions, and only if the mismatch persists should you post an adjustment.

Overview

Reconciles system records to physical inventory by adjusting quantity and cost basis.

Suggested cost logic aligns adjustments with the item’s standard cost or chosen valuation method.

Supports auditing via documented Reason, Notes/Comments, and use of appropriate Adjustment Account.

Encourages good control through best practices: use as a last resort, document every adjustment, run cycle counts, and review adjustment reports to spot recurring issues.

Where to Access

Users (admin / common) can access item via Inventory column (Inventory: Adjustment)

Click Add New to initiate inventory adjustment onto the ianaiERP system

Key Attributes

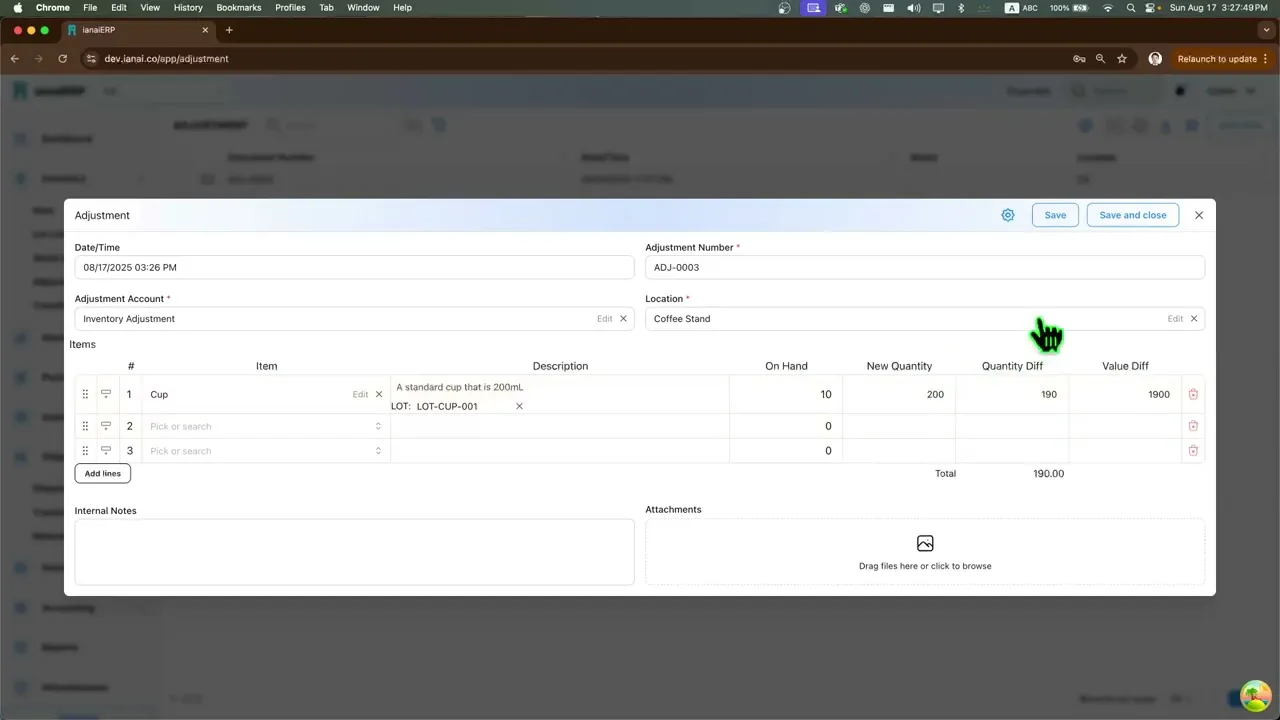

Header Fields (Adjustment Record)

Date: Effective date of the adjustment

Adjustment Number: Tracking number for the inventory adjustment

Location: Site where the adjustment occurs

Adjustment Account: Account to post the adjustment to (default can be set in Settings > General Settings).

Per-item lines

Item: The item being adjusted

Description: Brief description of the item

Current Quantity (On Hand) : System quantity at the time of adjustment (display only)

New Quantity or Quantity Change: Enter either the new total of the delta

Quantity Diff: System-calaulated difference (New-Current); shows units added/removed

Value Diff: Monetary impact of the line (inventory value change)

Notes/Comments: Additional context

Department: Tag the line to a department for reporting

Project Code: Tag the line to a project/job for tracking

Valuation Reference (for suggested cost)

For increases in quantity: system suggests cost based on the item's standard cost.

For decreases in quantity: suggestion is based on the selected valuation method (FIFO, LIFO, or Weighted Average).

Key Functions

Investigate first (history, missed/incorrect transactions); adjust only if mismatch remains.

Create an adjustment:

Navigate Inventory > Adjustment → Add New.

Enter Date, Location, Adjustment Account.

For each item: select Item, review Current Quantity, enter New Quantity or Quantity Change, optionally adjust Cost Basis, add Notes/Comments.

Save to process.

Adjust quantity & cost basis:

Enter either new total or change.

Adjust cost basis if needed.

Suggested cost uses standard cost (increase) or FIFO/LIFO/Weighted Average (decrease).

Related Features

For more detailed information on managing items, please refer to the specific sections in this documentation.

Join our Community Forum

Any other questions? Get in touch